0.6 Workers Per Retiree: The Trades Are Bleeding Out

For every technician retiring, only 0.6 new workers enter the trades. Here's what the data shows about the structural shortage hitting contractors.

Talk24 Team

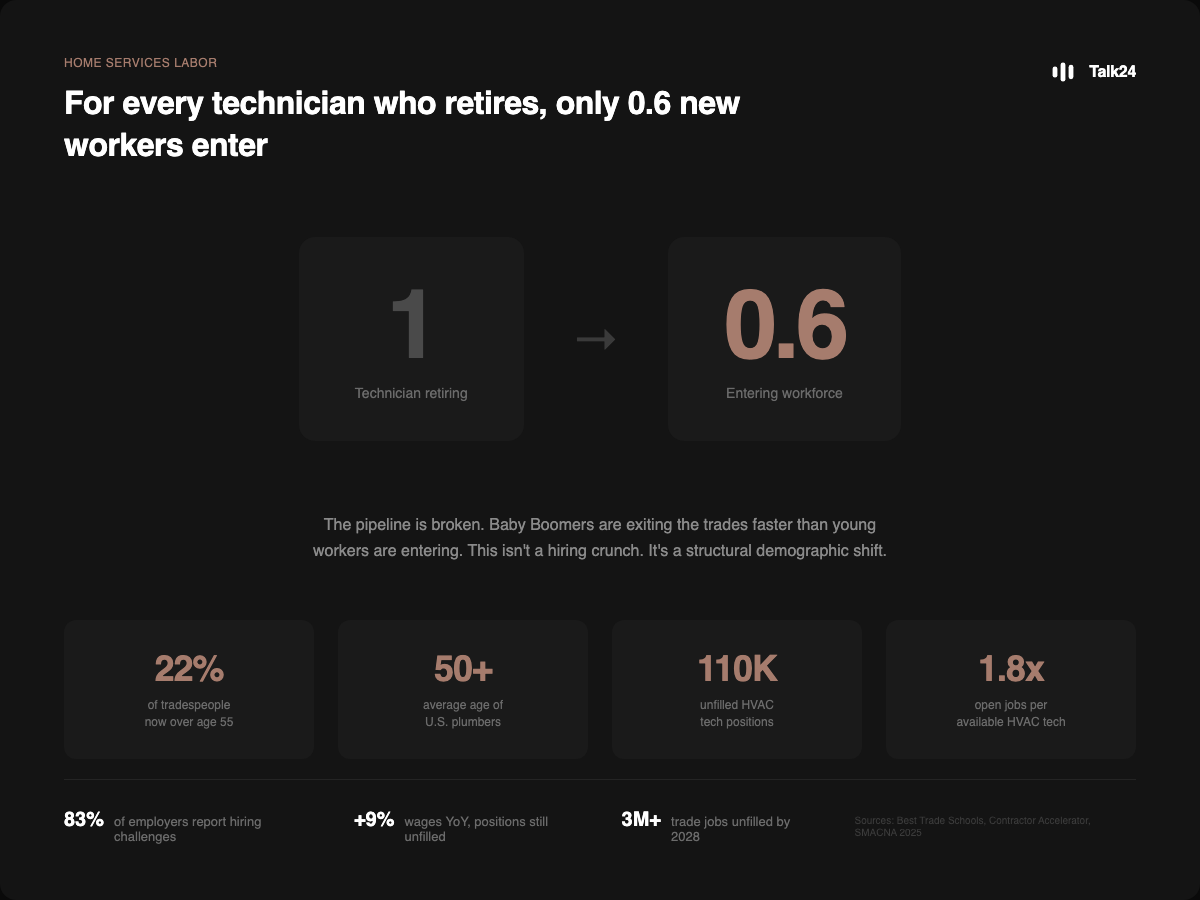

For every experienced technician who retires, only 0.6 new workers enter the trades.

That ratio means the industry is shrinking with every retirement. Signing bonuses and Indeed postings can't fix a pipeline that's draining faster than it fills.

The home services industry is facing a demographic shift that's been building for decades. Baby Boomers are exiting the trades faster than young workers are entering. And no amount of Indeed postings or signing bonuses will change the underlying math.

Here's what that replacement gap actually looks like:

The numbers get worse when you look at who's still working. Nearly a quarter of the current workforce is approaching retirement age, with no clear pipeline behind them.

The Retirement Wave Is Already Here

The data on workforce aging is stark:

22% of tradespeople are now over age 55. That's more than one in five workers who could exit the industry in the next decade. In some trades, the numbers are even more pronounced. The average age of plumbers in the U.S. is now over 50 years old, according to ZipDo's 2025 Skilled Trades Statistics.

This isn't a future problem. It's happening now. The combination of an aging workforce, declining trade school enrollment, and fewer young people choosing skilled trades has created what Contractor Accelerator calls a "perfect storm" in residential construction.

The HVAC industry alone has 110,000 unfilled technician positions, representing 38% of what the industry needs to meet current demand, according to SMACNA's 2025 industry report. That translates to 1.8 open jobs for every available HVAC technician.

Why Higher Wages Aren't Solving It

The obvious response to a labor shortage is to raise wages. Contractors have done exactly that. Residential construction compensation rose 9% year-over-year in 2024, with HVAC technicians specifically seeing increases of 3.5% or more across all skill levels.

It's not working.

Positions remain unfilled even as wages climb. According to Contracting Business, 83% of energy efficiency employers report ongoing hiring challenges despite competitive pay.

The problem isn't that contractors aren't paying enough. The problem is that there simply aren't enough trained workers to hire at any price. The supply side of the equation is broken.

The Revenue Impact Nobody Talks About

Every unfilled position has a direct cost that most contractors don't calculate.

Consider the math: an average HVAC technician generates between $200 and $650 per service call during peak season. Most techs handle 10-12 service calls per day during busy periods. That means a single unfilled position can cost between $2,000 and $7,800 per day in lost revenue, according to analysis from Mar-Hy Distributors.

For a contractor who can't fill two positions during a summer AC rush or a winter heating emergency, that's $4,000 to $15,000 per day walking out the door. Over a peak season, the losses compound into six figures.

And it's not just the lost revenue. Contractors often respond to understaffing by:

- Turning away jobs (lost customers who may never call back)

- Extending wait times (damaging reputation and reviews)

- Overworking existing staff (increasing turnover and errors)

- Hiring underqualified workers (creating quality and safety issues)

Each of these workarounds creates its own cascade of problems.

The Pipeline Problem

Why aren't more young workers entering the trades?

Several factors converge:

Cultural perception. For decades, high schools pushed four-year college as the default path. Trade careers were positioned as fallback options rather than viable first choices. That messaging shaped an entire generation's career decisions.

Training accessibility. Trade programs require investment in equipment, facilities, and instructors. Many community colleges and vocational programs have scaled back or closed entirely. The infrastructure for training new tradespeople has eroded.

Competition from other industries. Gig economy jobs, warehouse work, and other hourly employment compete for the same labor pool. A warehouse job doesn't require years of apprenticeship or certification.

Knowledge transfer gaps. As experienced tradespeople retire, institutional knowledge leaves with them. Master electricians who understand the integration of traditional electrical systems with modern digital controls represent irreplaceable expertise that takes years to develop.

The CSIS Future of Jobs Report projects this gap will grow to 3 million unfilled skilled trade jobs by 2028.

What Contractors Can Actually Do

Waiting for the labor market to correct itself isn't a strategy. The demographic trends won't reverse quickly, if ever. Contractors who want to grow, or even maintain their current capacity, need to adapt.

1. Maximize existing technician productivity.

If you can't hire more techs, make the ones you have more efficient. That means:

- Optimizing dispatch and routing to reduce windshield time

- Automating administrative tasks that pull techs away from billable work

- Ensuring parts and equipment are staged before jobs start

- Reducing callbacks through better first-time fix rates

Every hour saved on non-productive tasks is an hour that generates revenue.

2. Capture every lead, even when short-staffed.

When you're understaffed, the temptation is to let leads slip. The phone rings and nobody answers. The website form sits unresponded for hours. That's the worst possible response to a labor shortage.

Those leads represent future work when you do have capacity. Losing them means starting from zero when staffing improves. Automated intake systems can capture and qualify leads 24/7, booking appointments into available slots without requiring staff time.

3. Invest in retention, not just recruitment.

Hiring costs have skyrocketed. Every tech who leaves represents lost training investment and recruiting expense. Benefits, career progression, and workplace culture matter more than they did when workers had fewer options.

4. Build training pipelines internally.

Some contractors are partnering with local high schools and community colleges, offering apprenticeships, or running their own training programs. The upfront investment is significant, but it's one of the few ways to actually grow the available workforce.

The Bottom Line

The home services labor shortage isn't a temporary market condition. It's a structural demographic reality that will shape the industry for the next decade or more.

Contractors who recognize this are already adapting. They're building systems that maximize productivity per technician, capture leads even during staffing crunches, and invest in retention over constant recruiting.

The contractors still waiting for the labor market to fix itself may find themselves unable to serve customers at all.

Talk24 helps local service businesses capture and qualify leads 24/7 with multilingual AI-powered intake.

Related Articles

Industry Solutions

See how Talk24 helps these industries: