The Private Equity Roll-Up of HVAC: What the Numbers Actually Show

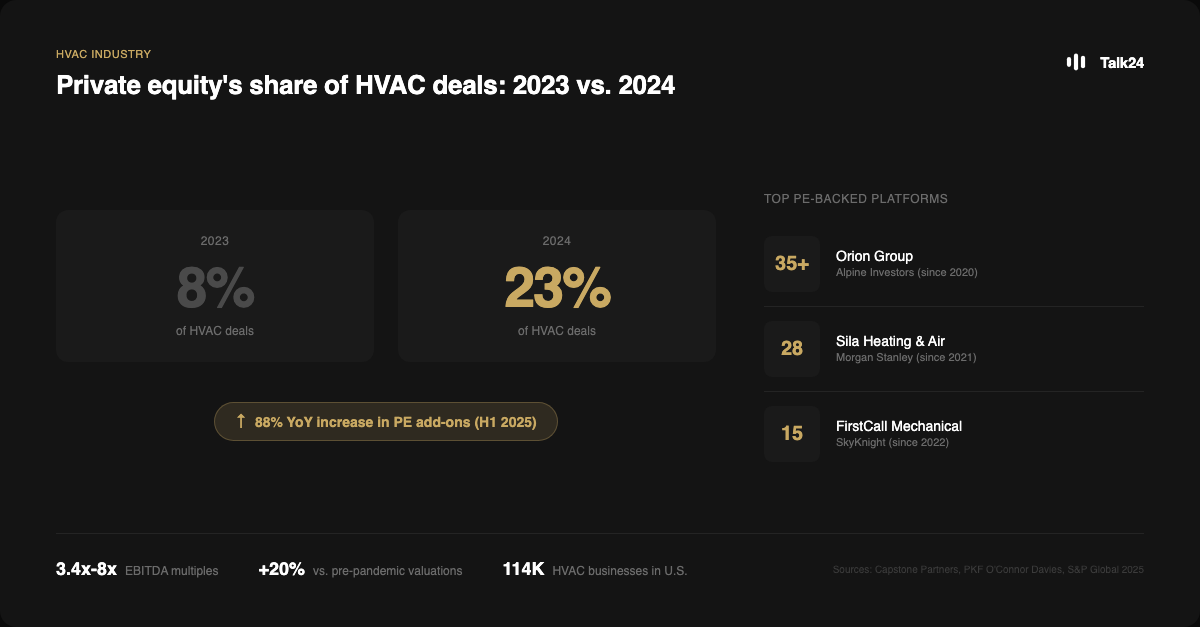

PE deal share jumped from 8% to 23% in one year. Here's what HVAC contractors need to know about the consolidation wave reshaping their industry.

Talk24 Team

In 2023, private equity accounted for 8% of HVAC deals. By 2024, that jumped to 23%.

If you're running an independent HVAC business, the competitor down the street may no longer be a family shop like yours. It might be a portfolio company backed by Morgan Stanley or Alpine Investors.

Those acquisition counts on the right are just three platforms. There are dozens more building regional and national footprints.

The Numbers Behind the Roll-Up

Private equity add-on transactions targeting HVAC service providers rose 88% year-over-year through June 2025, according to S&P Global Market Intelligence. In the first half of 2025 alone, PE firms and their platforms accounted for 39 of the 77 HVAC M&A deals recorded.

The total picture for 2025:

- 149 transactions announced or completed, up 12.9% from the prior year

- EBITDA multiples ranging from 3.4x to 8x, with premium businesses commanding 10x+

- Valuations up 20% compared to pre-pandemic levels

For context: a residential HVAC company generating $1.5 million in EBITDA with strong service contracts could sell for $9-10.5 million at current multiples.

Why PE Wants HVAC

The HVAC industry checks every box private equity looks for:

Fragmented market. There are roughly 114,000 HVAC businesses in the U.S., most of them family-owned. That fragmentation is catnip for roll-up strategies.

Recurring revenue. Service contracts and maintenance agreements provide predictable cash flow that's easy to underwrite.

Defensive demand. When the AC dies in August or the furnace fails in January, people pay whatever it takes. Economic downturns don't change that.

Aging owners. A lot of HVAC business owners are approaching retirement with no succession plan. PE offers an exit.

The Major Platforms

Three platforms show the scale of what's happening:

Orion Group has made over 35 acquisitions since Alpine Investors formed the platform in November 2020. Their focus is commercial facility services: HVAC/R, plumbing, and design-build work.

Sila Heating & Air Conditioning has completed 28 acquisitions since receiving investment from Morgan Stanley Capital Partners in May 2021.

FirstCall Mechanical has made 15 acquisitions since SkyKnight took control in January 2022, targeting the high-growth Southeast region.

According to Capstone Partners, many PE buyers who entered the space in 2020-2021 are now preparing exits. New financial buyers are launching fresh platform builds to replace them.

Where We Are in the Cycle

Industry analysts at PKF O'Connor Davies describe the residential HVAC services segment as "midway through a consolidation cycle." Commercial HVAC is still early.

"Midway through" means the easy acquisitions are done. The most attractive targets with clean books and clear succession needs have been picked off. But the market is still highly fragmented, so there's plenty of runway left.

For independent contractors, this creates a weird competitive environment. You may not be competing directly with Orion or Sila today, but their presence in adjacent markets affects pricing, talent, and customer expectations in yours.

What This Means for Independent Contractors

PE-backed competitors have advantages that are hard to match:

Equipment pricing. Platforms negotiating on behalf of 30 locations get better terms from manufacturers than a single shop.

Talent acquisition. During a technician shortage, better health insurance, retirement benefits, and career paths matter. A Morgan Stanley-backed company can afford benefits packages that squeeze independent operators.

Marketing budgets. Multi-state platforms can invest in digital marketing, SEO, and brand-building at a scale that doesn't pencil out for a single-location business.

One contractor quoted in Contracting Business described feeling "outgunned" as her newly acquired competitors could negotiate better deals on everything from equipment to workers' health insurance.

Where Independent Contractors Can Win

PE platforms have real vulnerabilities.

Integration is hard. Acquiring a company is the easy part. Integrating it while maintaining the culture, relationships, and service quality that made it valuable is much harder. A lot of acquisitions disrupt more than they improve.

Local relationships don't scale. The contractor who sponsors the Little League team, knows customers by name, and has serviced the same homes for 20 years has something no acquisition can replicate. One successful independent mentioned training his technicians to be "Super Techs" who help customers beyond their HVAC needs. That kind of service builds loyalty that survives a competitor's better pricing.

Speed and agility. Corporate approval layers slow decisions. An independent can say yes to a customer on the spot. A platform company might need to check with regional management.

Community identity. "The HVAC company in [your town]" resonates differently than a national brand that recently acquired the local shop and changed the name.

The Strategic Question

For HVAC business owners, this comes down to two paths.

If you're considering an exit: The multiples are as high as they've been. A service-heavy business with maintenance contracts, low owner dependency, and clean financials is exactly what PE is buying. Commercial owners may have even more leverage since that segment is earlier in the cycle.

If you're staying independent: Your competitor may soon have access to capital, pricing, and talent pipelines that didn't exist five years ago. The response isn't to try matching PE resources. It's to double down on what they can't buy: local reputation, personal relationships, service quality, and community presence.

Bottom Line

The HVAC industry is consolidating, and the deal data from 2024 and 2025 shows it's accelerating.

Whether you're planning to sell or planning to compete, knowing what you're up against is the starting point. The family shop down the street may soon be a portfolio company. The competitive dynamics you've relied on for decades are shifting.

Sources:

- Capstone Partners: HVAC Services M&A Update (July 2025)

- PKF O'Connor Davies: US HVAC M&A Industry Update (Summer 2025)

- S&P Global Market Intelligence (October 2025)

- First Page Sage: HVAC EBITDA & Valuation Multiples (2025)

- Contracting Business: Competing with Private Equity in HVAC

- ACHR News: How Small HVAC Contractors Can Compete Against Private Equity

Talk24 helps local service businesses capture and qualify leads 24/7 with multilingual AI-powered intake.

Industry Solutions

See how Talk24 helps these industries: