The PI Advertising Arms Race: What Small Firms Are Really Up Against

Morgan & Morgan spent $218M on ads in 2024. The average PI firm spends $15K/month. Here's how smaller firms compete without matching that budget.

Talk24 Team

Morgan & Morgan spent $218 million on advertising in 2024.

That's $18 million per month. More than most personal injury firms will gross in their entire existence.

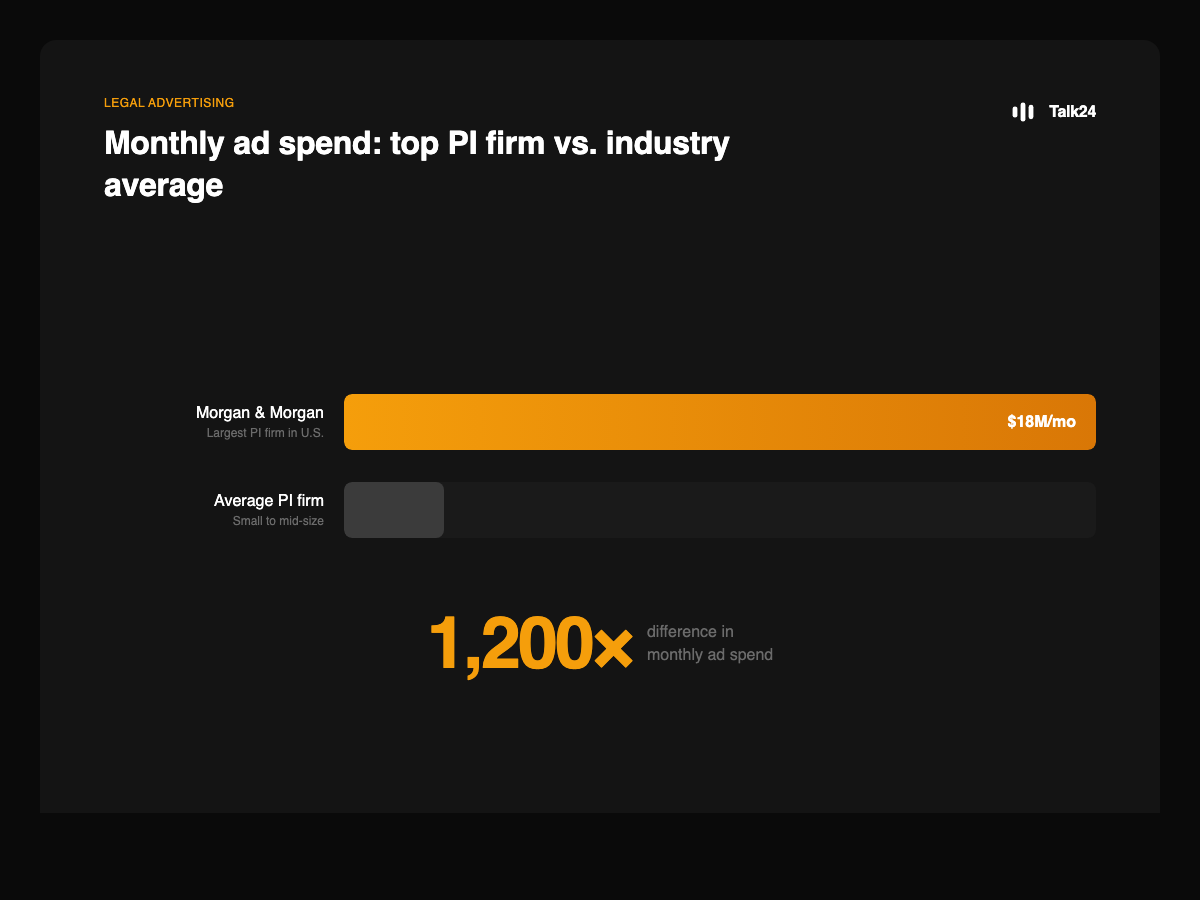

The average PI firm? About $15,000 per month on marketing. That's a 1,200-to-1 spending gap.

If you're running a small or mid-sized personal injury practice, this is the reality: you cannot outspend the giants. But that doesn't mean you can't compete.

Here's what that spending gap actually looks like:

That tiny bar on the bottom? That's your entire marketing budget. The math doesn't work in a head-to-head spending war.

The Numbers Behind the Arms Race

Trial lawyer advertising hit $2.5 billion in 2024, according to the American Tort Reform Association's annual report. That's a 32% increase since 2020.

Here's where the money goes:

- Morgan & Morgan alone accounts for 8% of all legal services ads nationwide

- Radio ads are up 261% since 2017

- Top 10 markets (LA, NYC, Atlanta, Orlando, Miami, Dallas, Tampa, Phoenix, Houston, Las Vegas) see the heaviest spending

These markets overlap heavily with ATRA's "Judicial Hellholes" designations. That's not a coincidence. Big firms spend where verdicts are highest.

What Small Firms Actually Spend

The typical personal injury firm allocates $5,000 to $20,000 monthly on marketing, according to MeanPug's industry analysis. Most consultants recommend 10-20% of gross revenue.

The economics are brutal:

- Cost per click: $70-$250 in personal injury

- Cost per lead: $700-$1,500

- Cost per signed case: $2,500-$3,000

At those rates, a $15,000 monthly budget buys somewhere between 10-20 leads. Maybe 3-5 signed cases if your intake is sharp.

Morgan & Morgan's $18 million monthly budget buys roughly 12,000-25,000 leads. The math simply doesn't work in a head-to-head spending war.

Why Competing on Spend Fails

The instinct for many firms is to try harder. Spend more. Buy more clicks. Run more ads.

This approach has three problems:

1. Diminishing returns kick in fast. The first $5,000 in spend usually generates better ROI than the next $50,000. As you scale, you're bidding against yourself and saturating your viable audience.

2. Big firms have infrastructure you don't. Morgan & Morgan employs dedicated media buyers, data scientists, and attribution specialists. They optimize at a level most small firms can't replicate. Even if you matched their spend ratio, you wouldn't match their efficiency.

3. Your margins can't support it. Mega-firms run on volume. They can accept lower margins per case because they're signing thousands. A small firm taking 50 cases a year needs higher margins per case to survive.

What Actually Works for Smaller Firms

The firms successfully competing against the billboard giants aren't playing the same game. They're winning on dimensions where size is a disadvantage.

Geographic Precision Over Broad Reach

Big firms blanket entire metros. They can't micro-target individual neighborhoods or zip codes profitably.

Small firms can. Know which three zip codes produce your best cases. Know which referral sources send the highest-value clients. Concentrate there instead of spreading thin.

One PI attorney in Houston told me he stopped all metro-wide advertising and focused exclusively on two suburbs where his conversion rate was 3x the average. His cost per signed case dropped by 60%.

Referral Networks Still Matter

Despite the advertising arms race, referral relationships remain a primary source of PI cases. Other attorneys, chiropractors, medical providers, past clients: these channels don't get outbid by Morgan & Morgan.

The irony: big firms spend millions on advertising partly because they can't build referral depth at scale. A managing partner who knows 200 local attorneys personally has something no ad budget can buy.

Speed Beats Spend

Here's where small firms hold a genuine advantage: response time.

79% of legal consumers hire the first attorney who responds meaningfully to their inquiry. Not the one with the biggest billboard. The first one who actually picks up.

Big firms struggle with this. Their intake systems route calls through layers. Their volume creates delays. A small firm that responds in 2 minutes beats a mega-firm that responds in 2 hours, regardless of ad spend.

This is the one competitive dimension that costs almost nothing to fix.

The "Billboard Lawyer" Stigma

Consumer sentiment toward heavy advertisers is mixed at best. Phrases like "billboard lawyer" and "TV attorney" carry negative connotations for many potential clients.

Smaller firms can position against this. Personal attention. Actual lawyer involvement. Not being treated as a file number. These resonate with clients who are already skeptical of the high-volume approach.

Building Depth Over Volume

The firms thriving despite the advertising arms race share a common trait: they stopped trying to be mini versions of Morgan & Morgan.

Instead, they built:

Narrow specialization. One firm handles only trucking accidents. Another focuses exclusively on medical device injuries. Specialists can charge higher fees and attract clients who want expertise, not just availability.

Local reputation. Being known as "the PI attorney" in a specific community beats being one of 50 firms bidding on "Houston car accident lawyer."

Operational efficiency. If you can't outspend on acquisition, you need to maximize value from every lead you do get. That means responding faster, qualifying better, and converting higher.

Referral investment. Time spent maintaining professional relationships often generates better ROI than equivalent ad spend.

The Real Question

The advertising arms race isn't going away. If anything, the ATRA data suggests it's accelerating.

But for most small and mid-sized PI firms, the path forward isn't matching that spend. It's recognizing that the game has different rules at different scales.

A firm with $15,000 monthly marketing budget can't compete with $18 million. But it can build advantages that $18 million can't buy: local depth, personal relationships, speed of response, and specialized expertise.

The giants are optimized for volume. They need thousands of cases to justify their overhead. That's a vulnerability, not just a strength.

Firms that exploit it, rather than trying to replicate it, are the ones finding space in an increasingly crowded market.

Sources:

Talk24 helps law firms capture and qualify leads 24/7 with multilingual AI-powered intake.